Table of Content

Not to mention by working with a trusted partner who presents the whole picture, they gain better insights into different loan features and how to position their mortgages ahead of interest rate cycles. They also save from doing early mortgage reviews with us every 2-3 years. The BR offered for your loan package may be different from BRs offered to other customers for different loan packages. The next step is to find out how much you can refinance your property for.

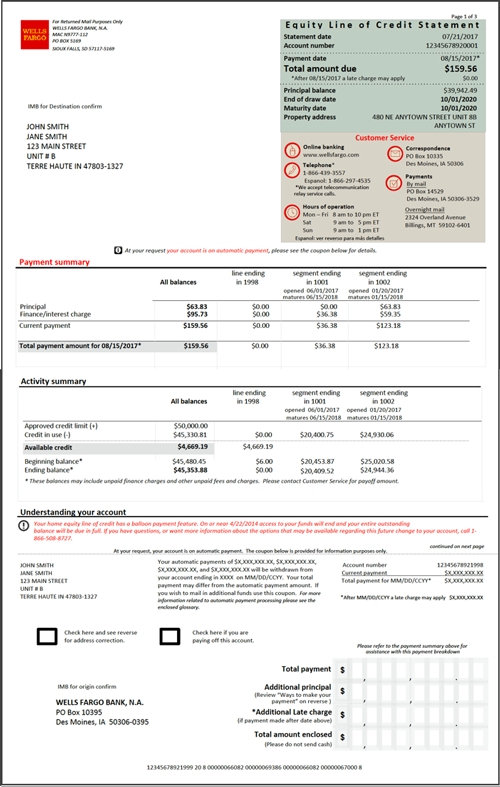

Statement of CPF withdrawn under Public Housing Scheme and 6 month's loan statements . A home loan that is flexible enough to accommodate all your financial needs. You can request for UOB to handle everything, from application submission to delivering the documents to your doorstep. You can withdraw surplus cash from your prepaid amount, anytime you want, for emergencies or any other reason. Fill up the details and our Home Loan specialists will reach out to you within the next business day. UOB may vary or suspend or terminate this Promotion without notice.

Branches / ATMs

The interest rate for a bridging loan is between 4% and 5% and differs from bank to bank. Personal Loan Greater control of finances with fixed monthly repayments. ~Flexible penalty waiver terms are for selected packages only and subject to the terms and conditions in the Letter of Offer and only applicable for new home loan sign-ups. Leverage on our property financing expertise and market insights to get the advice you need and help you make informed decisions.

It is processed and approved by UOB, and is subject to the applicable terms and conditions, including the necessary documentation verification and completion. The information and services may contain bugs, errors, problems or other limitations. We have no liability whatsoever for your use of any information or service. United Overseas Bank is one of the Big 3 banks in Singapore incorporated in 1935, with headquarters in Singapore. It has an unrivalled presence in Southeast Asia with a global network of more than 500 offices.

Banks and ATMs in Singapore Changi International Airport

Indicative Effective Lending Rate refers to the indicative annual effective lending rate for a standard 30-year housing loan / home financing product with financing amount of RM350k and has no lock-in period. The Board Rate quoted is applicable only for the loan package that you are interested in (eg. HDB flat financing at fixed rate). The financial indicator against which that BR is benchmarked, such as the SIBOR, Prime Rate or CPF rate, will also be disclosed. The maximum tenor for a bridging loan is six months and full repayment must be made by the end of that period.

If the permitted residential property purchased is under construction, you can opt to pay your instalments based on the disbursed loan amount until the Temporary Occupation Permit is issued. Thereafter the instalments will be calculated based on the outstanding over the outstanding loan duration. Since 2014, MortgageWise.sg has provided thought leadership in the mortgage planning space in Singapore, seeking to build trust with clients over the longer term rather than product-peddling for quick one-time deals. So, be it to refinance home loan, or if you are looking to buy Singapore condo, speak to our dedicated team of mortgage consultants here for the best home loan rates. The loan repayment schedule for the loan package that you have chosen is available in either hard copy or soft copy in the form of a home loan calculator on the bank's website. The BR can be changed by the bank anytime, by giving 30 days' notice, depending on market conditions and/or changes in the financial indicator against which the BR is benchmarked.

Credit Card

A bridging loan is a short term loan of up to a maximum of 6 months. The CPF Withdrawal Limit is capped at 120 per cent of the Valuation Limit of your property. The Valuation Limit is the lower of the purchase price or valuation amount at the point when you purchased your property. Home ownership is a long-term commitment that requires you to set aside a significant sum of money as a deposit and to then make regular mortgage repayments over the tenor of the loan.

Of course, we also offer a $150 FairPrice e-gift voucher for min loan of $800,000 giving very practical gift which helps to defray some costs. Promotional gifts are a dime a dozen, you can always get them anytime you need it. UOB Malaysia offers home loan that is flexible enough to accommodate all your financial needs.

In Singapore, UOB plays simply the market leaders role, when it comes to home loans, credit cards and loans for small businesses. With its extraordinary support, in 2011, it was honoured as the Best Retail Banker in Singapore and The Best SME banking group in the 10th International Excellence in Retail Financial Services Awards Program, organized by Asian Bankers. The 3 local banks collectively command more than 80% of the local mortgage market and most are familiar with their brands and have some sort of banking relationship with one or the other be it credit card or savings account. However, not all are familiar with their mortgage loan features which can be quite different and unique to each bank. Bridging Loans can be used for the purchase of private properties, HDB flats and Executive Condominums or ECs.

You may receive the approval for your bridging loan within two working days on condition that all necessary documents have been submitted. Plus, here’s a little sweetener - apply online now and receive an exclusive gift+ from us upon your home loan acceptance. Exclusively for Wealth Banking customers, enjoy additional valuation subsidy# of S$160.50 when you refinance your Private Home Loan (min. S$1million) with UOB. Before deciding which property to buy, you may find it useful to understand the relevant regulatory guides on foreign ownership of permitted residential property in Singapore. Foreigners are only permitted to acquire or purchase certain types of residential properties in Singapore. Please refer to theSingapore Land Authority’s websiteandHousing & Development Board’s websitefor the types of residential properties which foreigners may acquire or purchase in Singapore.

The monthly repayments are only on the interest charged, with no repayment on the Principal amount, which is repaid in full at end of the tenor. The principal amount can be repaid using either cash or CPF, subject to the CPF Withdrawal Limit. The quantum for a bridging loan is determined by the nett proceeds from the sale of the property. A bridging loan provides short-term financing to complete the purchase of a new property before the homebuyer receives the proceeds from the sale of their existing property.

For example, if you purchased your HDB flat at $500,000 and its valuation at the point was $530,000, the Valuation Limit will be $500,000. This means that your Withdrawal Limit will be $600,000, or 120 per cent of the Valuation Limit. With UOB Instant Home loan approval, you can get an in principle approval online, in the comfort of your home within minutes.

Letters of offer issued by UOB in connection with the UOB HDB Home Loan have to be accepted within the campaign period of 1 July 2022 to 9 January 2023. 2The indicative value is based on real-time proprietary data of CKS Property Consultants Pte Ltd, publicly available information and other third party sources. We do not warrant the accuracy or completeness of the information and valuations. Rent received from the letting of property in Singapore is subject to income tax. Your rental income includes rent of the premises, maintenance, furniture and fittings. After deductions for allowable expenses , the net amount is taxable.

Other benefitsSubmit your application online & our banker will be in touch with you to share more on our limited time promotional offers. Valid only for direct applications without third party referrals. T&Cs apply.Additional notesPromotional rates are available for a limited period and only valid for completed residential properties in Singapore, for your new purchase or refinancing from another bank/HDB. Subject to minimum loan size.Pegged to the 3-month Compounded SORA that is published onMAS' website.

Acceptable collateral are single houses, twin houses, town houses, shop houses, and residential condominiums. The minimum loan amount is THB 500,000 while the maximum loan is up to THB 50,000,000. For Construction, the maximum loan is 85% of appraised land value and construction value (70% for land value and 100% for construction value). For 2nd hand house, the maximum loan is % of the appraised value and 80-90% for upcountry (For Condominium, maximum loan is % of the appraised value and 75-90% for upcountry).

You should consult your own professional advisors about issues discussed herein. While the information provided in this publication is believed to be accurate as at the date of publishing, UOB makes no representation or warranty, and accepts no responsibility or liability for its completeness or accuracy. UOB Home Loan offers wide range of home loan packages and flexible financing options to tailor your financial needs. Our packages include Fixed Rate package, Floating Rate Package and SORA-pegged rate package, or up to a combination of 2 of these packages.

No comments:

Post a Comment